By DAVID STREITFELD

Published: May 31, 2011

Multimedia

Readers' Comments

Share your thoughts.

Share your thoughts.

If you thought the housing crisis was bad, think again.

It's worse.

| More fromMarketWatch.com: • Holding TIPS Will Make You Poorer • Benchmark 30-Year Mortgage Rate Matches 2011 Low • Investors Pull Money From Commodity Sector Funds |

New data just out from Zillow, the real-estate information company, show house prices are falling at their fastest rate since the Lehman collapse.

Average home prices are down 8% from a year ago, 3% over the quarter, and are falling at about 1% every month, according to Zillow.

And the percentage of homeowners in negative-equity positions — with a home worth less than its mortgage — has rocketed to 28%, a new crisis high.

Zillow now predicts prices will fall about 8% this year and says it no longer expects the market to bottom before 2012.

"There's no way we can get to flat, from these depreciation levels, in the last nine months of the year," says Zillow economist Stan Humphries. "Demand is a lot more anemic than we had previously thought."

When in 2012 does Zillow see the market bottoming out? Humphries won't say.

What a foolish boondoggle those tax breaks for home buyers have turned out to be. The government spent an estimated $22 billion between 2008 and 2010 on tax breaks to prop up the housing market. All it achieved was a brief suckers' rally that ended last summer.

"As we said at the time, it was a giant waste of money," says Mark Calabria, economist at the conservative Cato Institute. "None of these things really turned the housing market around. They just put off the adjustment for awhile."

It's hard to overestimate the scale of the carnage in the housing market. Zillow found prices fell in all but four U.S. metro areas.

Falling real-estate prices mean spiraling hidden losses throughout the economy, from banks to homeowners.

Remember Japan's "zombie banks"? These were the financial institutions that haunted that country's economic recovery after the 1990 crash. They staggered on with huge losses they could never repay — the walking dead.

Here in America we have "zombie homeowners." Millions of them. According to Zillow, a record 16.3 million families are upside-down on their home loans. Sixteen million! And many are a long way upside-down. Their homes may never be worth as much as their mortgage. But they are hemorrhaging cash to pay the nut every month.

Recovery? What recovery? This looks a bit like a depression to me.

What does this mean?

All the misery makes me think of a great French general, Ferdinand Foch. He's the one who defended Paris at the Battle of the Marne in World War I. During the darkest hour of the fighting, he is supposed to have looked around him and said:

"Hard pressed on my right. My center is yielding. Impossible to maneuver. Situation excellent — I attack!"

In other words, when it comes to distressed housing, I'm finding it hard not to be a contrarian bull.

Why? Am I crazy?

Well, maybe. But I'm a medium-bull for all the reasons everyone else is gloomy.

First, prices in many areas are now cheap. They have corrected a long way since the bubble began to burst five years ago. Of course, it depends on where you are. I'm still skeptical of the real-estate markets that have held up best — prime stuff like Manhattan, San Francisco or Beverly Hills. It's hard to get a deal there.

But in the places that have fallen the furthest, there are deals aplenty. Zillow found only four metro areas in America that have leveled out, or risen, lately. Notably, two of those are in stricken Florida — Fort Myers and Sarasota. Have they fallen so far they've hit bottom? Maybe.

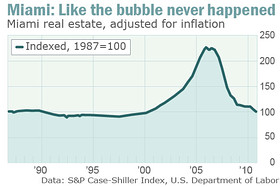

Look at this chart. It shows Miami real-estate prices, adjusted for inflation, over the past quarter-century, using Case-Shiller data. The picture is pretty remarkable. The gigantic bubble has been completely wiped out. We're back to prices seen in the 1980s — when "Miami Vice" was on the air.

The second reason: There are tons of foreclosures and short sales on the market. And there are plenty more sitting in the wings. Banks are holding back big shadow inventories of homes. And that means you can get a great deal. They have to sell. You don't have to buy. You hold all the cards. Remember, the name of the game isn't "let's make a deal." It's "take it or leave it."

Third, in many places rental yields are terrific. It's cheaper to own than to rent. There have been some forced sales in my building in Miami. Based on my math, the latest buyers have bought condominium units for six times gross annual rents, and maybe 12 times net rents. We're talking net yields of 7% or more. And rents are rising, because so many former owners are now renters.

The fourth reason I'm bullish is that you can get a very cheap mortgage. Thirty-year conforming loans are going as low as 4.3%. Throw in the tax break on the interest, and you are talking cheap finance.

The fifth reason is that, as painful as this collapse has been, real estate has historically proven to offer very good long-term protection against inflation. Returns have typically averaged about 1% or 2% above inflation. At a time when everyone has been piling into gold, commodities and TIPS bonds to protect themselves against the possibility of inflation, it seems odd that the most popular and successful hedge, namely real estate, goes a-begging.

Thirty-year TIPS bonds are yielding just 1.6% over inflation, and shorter-term bonds offer even lower returns. Short-term TIPS are actually offering negative real yields.

The sixth reason I'm bullish is perverse, but I'm sticking by it. Everyone else is bearish. You cannot find a real-estate bull anywhere. No one wants to own this asset. No one wants to talk about it. No one wants to hear about it. Everyone seems to agree it's just going down, down, down — forever.

They said much the same about stocks in 1987, 2002 and 2009; Treasury bonds in 1982; and gold in 2000. I cannot prove this is capitulation, but it sure smells something like it.

As ever, if you aren't disciplined and patient, this probably isn't for you.

I have absolutely no idea when real estate is going to hit rock bottom. It may take several years. I suspect it will do so in different markets at different times. But there are good homes out there going really cheap. If you hunt down the bargains, you're disciplined about price, you get the right financing, and you hold on for five years or more, you'll probably do pretty well from here.

Brett Arends is a senior columnist for MarketWatch and a personal-finance columnist for the Wall Street Journal.

___