NEW YORK (CNNMoney) -- Great news! There is no inflation to speak of -- unless you fancy a burger, cup of Joe or candy bar every now and then.

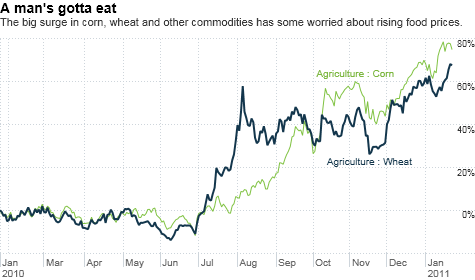

Yes, inflation may not technically be a problem just yet if you look at the latest consumer price index figures. But agricultural commodities like wheat, corn, coffee and cocoa have all surged in recent months.

Assuming you are a carbon-based life form that actually needs to eat --no offense to IBM (IBM, Fortune 500) "Jeopardy" savant Watson in case it? he? is reading this -- this is not good news.Some food and beverage companies have already reacted to higher commodity costs with price hikes while others are discussing the possibility of raising prices.

Starbucks (SBUX, Fortune 500), for example, has boosted the price of some drinks. And the chief financial officer of McDonald's (MCD, Fortune 500) hinted in an earnings conference call with analysts Monday that the company may "raise prices where it makes sense" in reaction to higher prices of beef and other commodities.

So the spike in commodity prices bears watching even if inflation doves can point to the fact that the cost of food is up just 1.5% in the past 12 months according to the December CPI report.

Food prices may be a bigger issue in emerging markets like China and India, where fears of runaway inflation have actually led central banks there to start raising interest rates.

But some worry that those problems will soon find their way to the U.S. as well.

"Higher inflation in food prices is not going to be contained to Asia. At some point, it's going to have a major impact on the American consumer," said John Norris, managing director with Oakworth Private Bank in Birmingham, Ala.

Norris said that before economists, or for that matter the Federal Reserve, dismiss higher food prices a still non-existent or phantom threat, people should dig into the government's CPI data a little further.

According to the December report, the prices of meat, poultry, fish and eggs were up 5.5% in the past 12 months. Milk and other dairy product prices rose 3.7%.

"The price of stuff that we need every day, week in and week out are going up at a much higher pace than many other goods," Norris said. "The consumer notices when they go to the grocery store and the bill for meat and dairy is significantly higher."

Will the Fed address this when it releases its next policy statement on Wednesday? After its last meeting, the Fed reiterated that it believes "measures of underlying inflation are somewhat low."

Diane Swonk. chief economist with Mesirow Financial in Chicago, said the issue isn't really inflation per se in the classic sense. Fears of 1970s style inflation are a bit overwrought.

"You can't have major inflation without wage growth and that's just not happening," she said.

But Thomas Cooley, professor of economics at NYU Stern, said the Fed can't ignore inflation altogether. He noted that there is possibly some good news for consumers on that front.

Cooley said the addition of Philadelphia Fed president Charles Plosser and Dallas Fed president Richard Fisher -- two unabashed inflation hawks -- to the Fed's monetary policy committee this year could mean that worries about rising prices won't completely fall on deaf ears.

"It's natural for people to be concerned about rising commodity prices, especially since food and energy costs are creeping up," Cooley said. "But with people like Plosser and Fisher, the Fed will be very wary of any inflationary pressures. I don't think the Fed will take its eye off the ball."

That's slightly reassuring. In addition, Cooley argues that one reason food prices are rising is because of strong demand from emerging markets. Translation: A rebounding global economy is leading to higher prices. As it should.

Trouble is that the Fed can't do much to combat the effect of rising food prices in other markets while it continues to buy long-term bonds, a policy that may hurt the dollar and inflate commodity prices further. So the U.S. consumer pays the price.

It's already happening with oil and gas prices and now food seems to be next.

And Swonk said as long as prices for important items like food are increasing at a time when consumers are still licking their financial wounds from the Great Recession, that's bad news.

"When food prices are going up because of what's happening globally, there's a trade off elsewhere," she said. "Consumers' budgets are already constrained. Many can't afford higher prices."