Karl Denninger

Market Ticker

Nov 13, 2009

For two and a half years The Market Ticker has pointed out the foibles of The Fed and other claims of "help" for the economy - when the prescription for "help" is just an extension of the same failed policies that created the mess in the first place.

But now we are starting to see this show up in the so-called "mainstream media", with the latest being The Wall Street Journal:

It takes similar reasoning to reconcile the elation felt across America every time the stock market rises - partially replenishing personal investment portfolios and 401(k) retirement plans - with the uneasy feeling that we are being set up for yet another big financial disappointment. We dare to hope that the economy is growing solidly once more, that the Federal Reserve has superior knowledge about providing liquidity, and that the U.S. Treasury knows what it's doing by guaranteeing money market-fund assets.

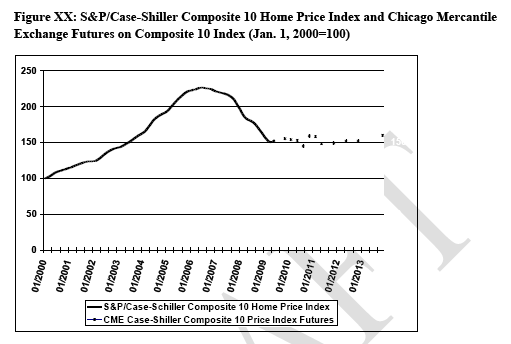

But what if the Fed's efforts to stoke a recovery are merely creating asset bubbles in equities and elsewhere? What if government guarantees - explicit and implicit - are encouraging high-risk investment behavior rather than restoring conditions for normal market returns? What if excess dollars produced here are being channeled by speculators into foreign stock and bond markets as part of a currency play?

No, really? Did you get that from the correlation charts of the dollar and S&P 500? You know, this one, showing correlation from March onward:

Judy continues to opine:

Deflation is seen as the bugaboo of Keynesian economics. But it can actually serve to spur economic activity as lower prices enable struggling consumers to get back in the game, and enterprising individuals can build businesses using tangible assets that yield valid profits.

But the Fed seems to think that prices should only go in one direction - up - no matter the circumstances. It's this bias toward inflation that is revealed by the FOMC's reference to "stable inflation expectations" - which is less a paean to price stability than an inadvertent oxymoron.

What Judy misses (perhaps because she's unaware of it, or perhaps because she simply doesn't feel comfortable saying it) is that deflation destroys over-levered debtors. It forces them into bankruptcy.

When that happens to the "little people" (that is, you and I) it doesn't matter to the oligarchs and robber barons on both Wall Street and Washington DC.

But defaults also destroy lenders who made imprudent loans. That's unacceptable as a matter of Washington DC's bought-and-paid-for policy, which is why we have Treasury Secretaries and the Chairman of The Fed corralling Representatives and Senators in a room and literally threatening them with the collapse of America if they don't fork up $700 billion of taxpayer funds for an open-ended, one-page slush fund that includes absolute legal immunity for whatever might be done with it.

If this had ended at $700 billion it would have been bad, but it didn't. No, The Fed then continued onward to announce the purchase of $1.2 trillion dollars (that's $1,200 billion more!) of debt and securities that, according to Section 14 of The Federal Reserve Act, they are not lawfully allowed to buy. (Section 13.3, often cited as justification, only allows the making of loans - not the purchase of assets. All purchase authority rests in Section 14.)

The FDIC then stepped outside of its legal mandate as well, "deciding" to guarantee bond issuance by banks - something that has absolutely nothing to do with depositor insurance. Why? Because once again, it is unacceptable in the Washington DC establishment if those who make bad loans - on purpose - have to eat them. Only the borrower - that is, the "ordinary Joe" - is allowed to have his future destroyed. The lender, who is supposed to also lose his money when he makes a bad decision (thereby providing a strong disincentive to making bad loans) is to be protected by the taxpayer, thereby screwing the borrower twice - first by bankrupting him, then demanding that he bear the cost for the lender who made the bad lending decision as well!

Now here's the scary part: Even though more than half of all American households now own equities directly or through mutual funds, an increase in equity prices does not figure into the Fed's calculation of inflation. So while measures of core inflation (which exclude food and energy) carefully register minute gains in the price of a fixed basket of goods and services meant to reflect what a typical family buys to achieve a minimum standard of living, they ignore massive price surges in what has effectively become a widely held consumer good: stocks.

Moreover, the Fed's inflation-targeting approach overlooks price increases for real estate and rising commodity prices. Don't even mention gold, which has gone from $707 to $1,114 since a year ago.

Of course not.

But again, this is by design. The Fed is intentionally applying the wrong standard for the construction of the monetary base, because if it were to not it would have to recognize the asset price moves that underlay the actual economy in its economic numbers. This, in turn, would have led housing price increases to have been reflected in monetary aggregates and people would have freaked out starting in about 2004 - instantly derailing the bubble before it could get going.

As I have repeatedly argued if you get the original premise wrong everything else you do from that point forward is also wrong.

The monetary base in a credit-based monetary system is not "M0", "M1" or "M'" (M-prime.) It is the unencumbered assets against which one is both willing and able to borrow.

Further, the definition of sound lending is not predicated on some leverage limit or wildly-distorted view such as Basel-II. It is in fact very simple: if one never lends unsecured beyond one's capital there is never a systemic risk that can arise.

Here's the problem with all the games once one gets down to brass tacks: you cannot screw people indefinitely and expect them to come back for more abuse. Oh sure, you can occasionally con people a second time, but since these "big interests" rely on a continued volume of business. ...

As just one example, how many municipalities will buy interest-rate derivatives from one of these "big banks" after the disclosure that Jefferson County overpaid by 400% - and a good part of that overpayment went to bribes? Further, it has become clear that the municipal government didn't understand the risks involved - and one can reasonably presume that was because those risks were intentionally hidden - probably by the bribing parties, the recipients of the bribes, or both.

There are solutions here but it is increasingly obvious that if Government doesn't step in the market will. All I have to do is look at volume - the percentage that is represented by "high frequency computer trades" has gone sky-high since last fall, yet volume has been dropping dramatically since March.

When the market degenerates down to a handful of trading houses with high-frequency trading computers passing the same 100 shares back and forth between themselves as the remainder of the market participants have gotten tired of getting reamed on a daily basis due to the cheating and decide to take their ball and go home, how do the "big trading houses" make money?

We're witnessing the destruction of the capital markets as the system is imploding from within as a direct and proximate consequence of willful blindness and outright fraud.

Nov 12, 2009

Karl Denninger